For most, a credit history are a valuable achievement, having reviews stretching with the 700 otherwise 800 worth range. For many individuals even though, a credit rating are several that might be increased.

Some Us citizens features a credit score below 700, acquiring a higher rating helps you safe better terms and conditions on fund, plus lower interest rates. But what if you like assistance with your credit rating? Reported by users, could there be an application for that?

The good news is, you’ll find actually some programs so you can alter your borrowing get. Having fun with a software usually takes time for you raise your credit rating, however, an application will help you that have get yourself ready for a very robust economic upcoming.

Just like the repayments are built, Worry about accounts their into-go out costs towards the about three primary credit reporting agencies (Experian, TransUnion and you will Equifax), helping improve your credit rating

- Experian

- Borrowing from the bank Karma

- Self

- Kikoff

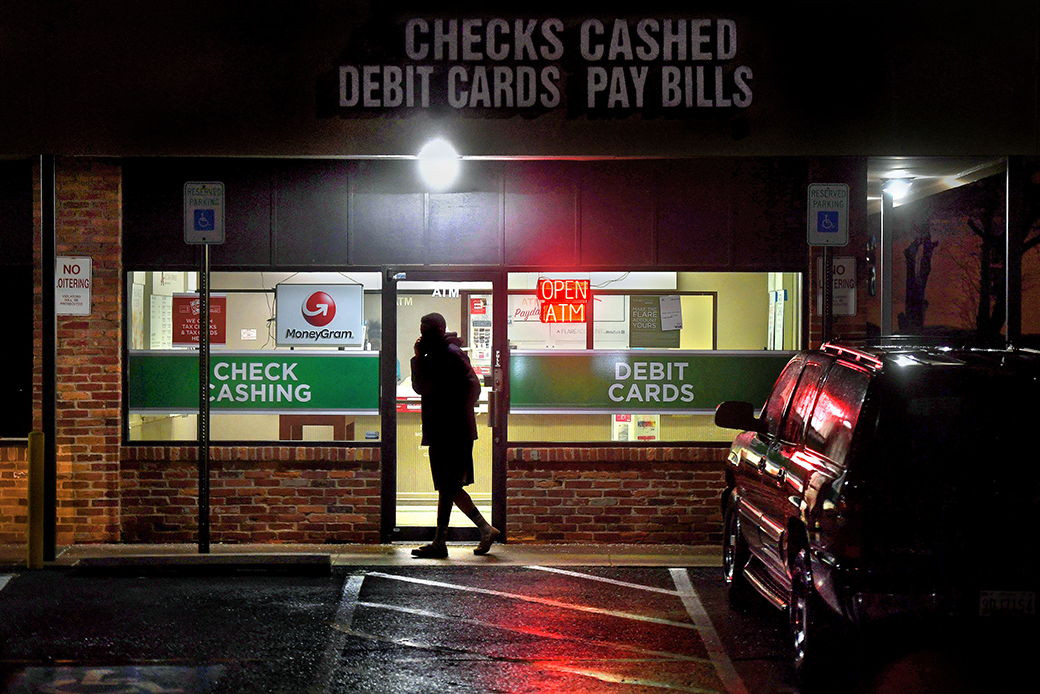

- MoneyLion

- Build Borrowing from the bank

As repayments are built, Self reports your to the-time costs to the about three number 1 credit agencies (Experian, TransUnion and you will Equifax), helping to raise your credit score

- No-costs updated look at the Experian get

- Membership the real deal-time credit keeping track of

- Free Experian Increase to improve credit score

Experian is just one of the about three major credit agencies you to definitely collects and you can profile debt pointers once the an effective around three-little finger amount – aka your credit rating .

A credit score facilitate other companies determine how risky its in order to loan you currency centered on the borrowing from the bank and you may payment record.

Understanding where you are is the best cure for start building your credit score

About free Experian software, you should check your own latest Experian credit score and results from Equifax and TransUnion, which happen to be current yearly.

If you choose to pay money for the brand new Experian application, you can receive your latest credit rating on almost every other two bureaus. The brand new subscription is costly however, now offers an entire image of your newest borrowing from the bank problem.

One 100 % free function we like is actually Experian Increase, and this contributes recurring bills for the credit history to assist boost your credit score. You will need at least three continual repayments, such as electric bills or lingering subscriptions to HBO Max otherwise Netflix.

If you have ever wrestled with your credit rating, you probably used or at least been aware of Borrowing Karma . This private finance company support Us americans look for its fico scores within totally free.

Although Borrowing Karma’s credit rating reporting might be inflated on account of making use of the Vantage rating program, rather than the more prevalent FICO credit history. quick loans Ridgebury CT Still, your Vantage credit score will be adequate to leave you a great rough thought of where you stand.

Other notable quirk: Borrowing Karma just profile TransUnion and you can Equifax scores. You’ll need to independently look at the Experian credit history, either on the web or perhaps in this new Experian app.

The true reason we like Credit Karma is the fact that the application demonstrates to you this new bad and the good circumstances affecting your results, allowing you to look for facts so you can best her or him and you can improve your credit history.

This service membership has built-in units for understanding credit cards and you can money you to definitely greatest meets your current financial situation and you may credit score.

This registration-situated application enables you to take out a small mortgage and repay it to help you create borrowing. (Your actually rating every cash return in the end.)

To start, get a card Builder membership with Care about to get an effective credit builder financing. Don’t be concerned. There will be no tough draws on your credit history. Once accepted, you can pick a cost amount and loan complete to begin with and work out costs.